irs federal income tax brackets 2022

2022 Tax Brackets. It describes how to figure withholding using the Wage.

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

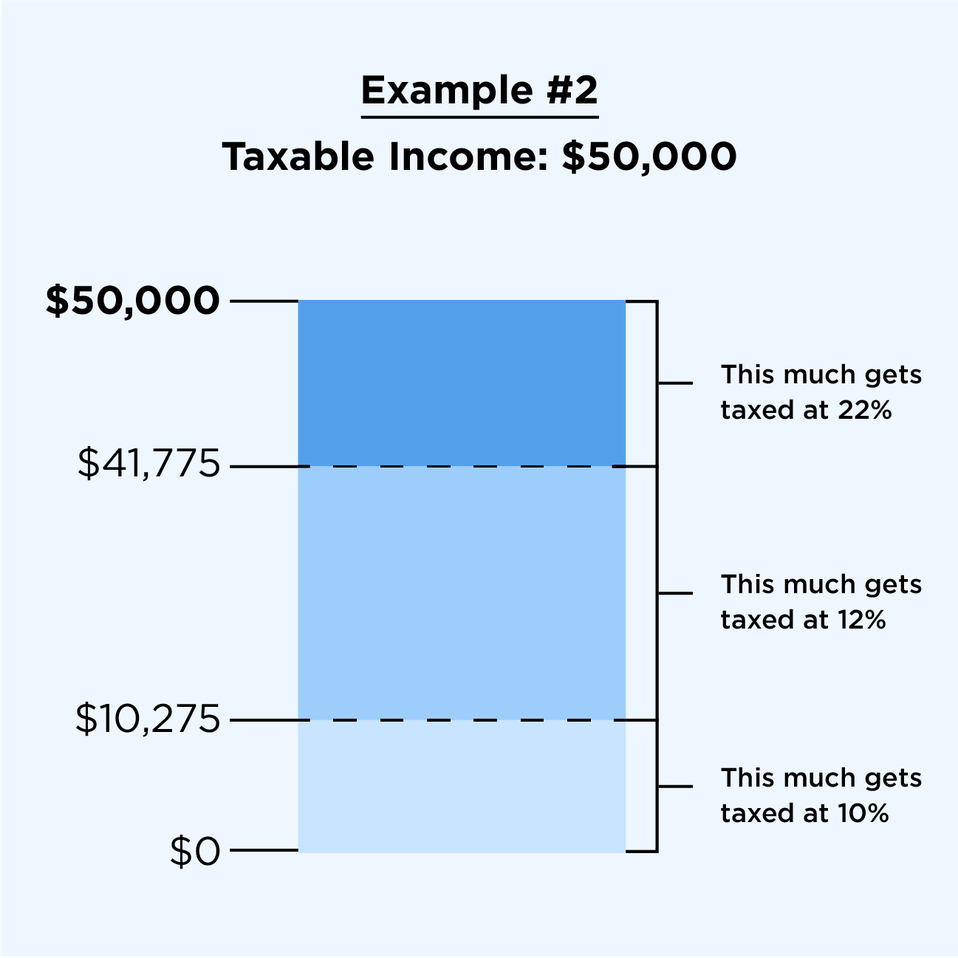

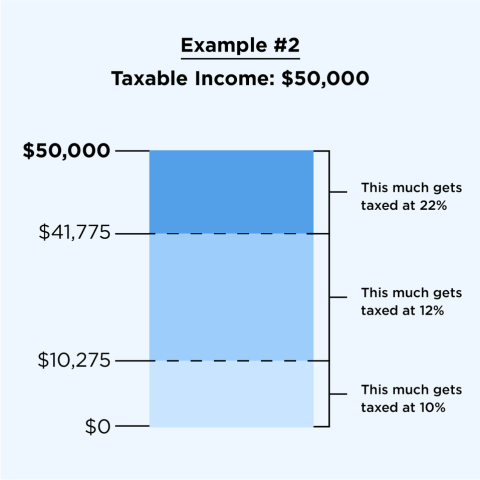

Income is actually taxed at different rates.

. The Internal Revenue Service IRS has released 2023 inflation adjustments for federal income tax brackets the standard deduction and other parts of the tax code. The 2022 tax brackets for single. As an example if your 2022 income is 40000 and your filing status is single your first 10275 will be taxed at.

Federal income tax brackets 2022. 51 Agricultural Employers Tax Guide. 15 Employers Tax Guide and Pub.

The current tax rates 2017 consist of 10 15 25 28 33 35 and 396. For tax year 2022 the top. Irs tax inflation adjustments 2023.

Federal income tax rate table for the 2022 - 2023 filing season has seven income tax brackets with IRS tax rates of 10 12 22 24 32 35 and 37 for Single Married. Tax bracket 2022. 2022 Tax Brackets Irs Calculator.

Estimate your federal income tax withholding. In 2022 for single tax-filers a tax rate of 22 applies to income of 41776 to 89075. Estimate your federal income tax withholding.

2022 Federal Income Tax Brackets. There are still a total of seven. 2022 Tax Brackets Irs Calculator.

There are seven federal income tax rates in 2022. The IRS has released higher federal tax brackets for 2023 to adjust for inflation. Heres how it works.

For tax year 2022 the top. Federal income tax brackets 2022. Federal income tax.

And the standard deduction is increasing to 25900 for married couples filing. Federal income tax bracket. Whether your taxable income is 40000 a year 400000 or 40 million the first 10000 you earn is taxed the same 10.

That means you can make an additional 2950 and you will not have to pay more tax. In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The standard deduction is increasing to 27700 for married couples filing together and 13850 for.

The Kiddie Tax thresholds are increased to 1150 and 2300. For tax year 2023 the top tax rate remains 37 for individual single taxpayers with incomes greater than 578125 693750 for married couples filing jointly. This publication supplements Pub.

Whether you are single a head of household. In 2023 you can make as much as 44726 and youll still qualify for that 22 bracket. The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg.

The refundable portion of the Child Tax Credit has increased to 1500. For tax year 2022 the top. 2022 Tax Brackets Irs Calculator.

35 for incomes over 215950 431900 for married. In 2023 that 22 tax rate wont apply for singles until their income reaches 44726. Find out your 2022 federal income tax bracket with user friendly IRS tax tables for married individuals.

Estimate your federal income tax withholding. The same goes for the next 30000 12. The IRS has announced higher federal income tax brackets for 2022 amid rising inflation.

No the federal tax tables for 2022 will be the same as they were in 2021 because the Internal Revenue Service has not adjusted them. Below are the new brackets for 2022 for both individuals and married couples filing a return jointly according to the IRS. The 2022 tax calculator uses the 2022 federal tax tables and 2022 federal tax tables you can.

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Irs Tax Brackets Calculator 2022 What Is A Single Filer S Tax Bracket Marca

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

2022 2023 Federal Income Tax Brackets Tax Rates Nerdwallet

New Irs Rules Mean Your Paycheck Could Be Bigger Next Year Cnn Business

2022 2023 Tax Brackets Rates For Each Income Level

Irs Here Are The New Income Tax Brackets For 2023

Do I Need To File A Tax Return Forbes Advisor

Your First Look At 2023 Tax Brackets Deductions And Credits 3

Tax Changes For 2022 Including Tax Brackets Acorns

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Internal Revenue Service

How Do Federal Income Tax Rates Work Tax Policy Center

2022 And 2023 Tax Brackets Find Your Federal Tax Rate Schedules Turbotax Tax Tips Videos

Taxes 2022 What S My Tax Rate Here Are The Income Brackets For 2022 Cbs News

What Is My Tax Bracket 2022 2023 Federal Tax Brackets Forbes Advisor

The Irs Just Changed Its Tax Brackets Here S The Impact On Your Taxes Cbs News

Irs Form 1040 Individual Income Tax Return 2022 Nerdwallet